Knowing Your Spending Is The First Step To Manage Your Debt

Do you know how to manage your debt? How many people grow up learning how to make a budget or manage debt? It’s not the first thing we learn about money. Spending is the first thing we learn. Unless you have really frugal parents, you may not know how to manage your money. Much less, how to manage your debt. You may not think about your spending until you get into trouble. And then sleepless nights follow when you’re worrying about money and how to get out of debt.

Know What Causes Debt

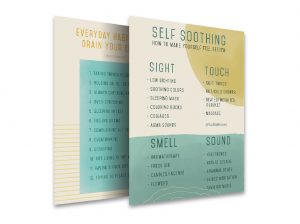

Can you manage your debt without knowing where your debt comes from? Knowing where your money goes may seem like a simple question, but think for a second about what may be happening in your life, and what’s changed in the last two years. You may be a careless spender or habitual spender, and that’s the problem. But there can be other causes.

Everyone has some debt. Debts always include: where you live, whether you rent or have a mortgage, child care, utilities, food and credit cards. Since the pandemic, however, we’ve seen more job loss, rising costs, people resigning or deciding not to go back to work. Where does the money come from now?

In addition, many people are working from home and that may trigger a new kind of spending. Are you surfing the web for daily purchases you don’t need? We do. Did you know that spending just a few extra dollars a day can lead to thousands of dollars in growing credit card debt? Spending what you have from day to day can lead to over spending even when you think you’re being careful, and then growing debt can be the most worrying part of your life.

Debt Management Is All About Planning

You can manage your debt, or get out of debt, in a variety of ways. Debt relief, like going bankrupt, is one way. But it’s drastic and can make matters worse. A better approach is to examine your debt and use an app like debt payoff planner which breaks down your options and ways to organize and eliminate your debt. There are many apps to do this: Tally can help you consolidate your credit card debt into one monthly payment, explore other options, and learn more about how to handle your finances. Another helpful option is to join Debtors Anonymous and create your own plan with the help of other members to get and stay out debt.

Use A Financial Planner

If you’re someone who always goes to others for help to bail you out, you will never get out of debt. But there are always people who can offer great advice and support. Reach out to a financial advisor if you are struggling to make sense of the responsibilities you have. Talk to people you trust who have been through something similar. Like everything else in life, when you have a problem, it’s always best to ask someone who has been there and solved it.

More resources to explore.

Money Worries? Help Is On The Way

Financial Safety When A Loved One Uses

How To Recover From Financial Hardship

7 Tips For Business Financial Planning