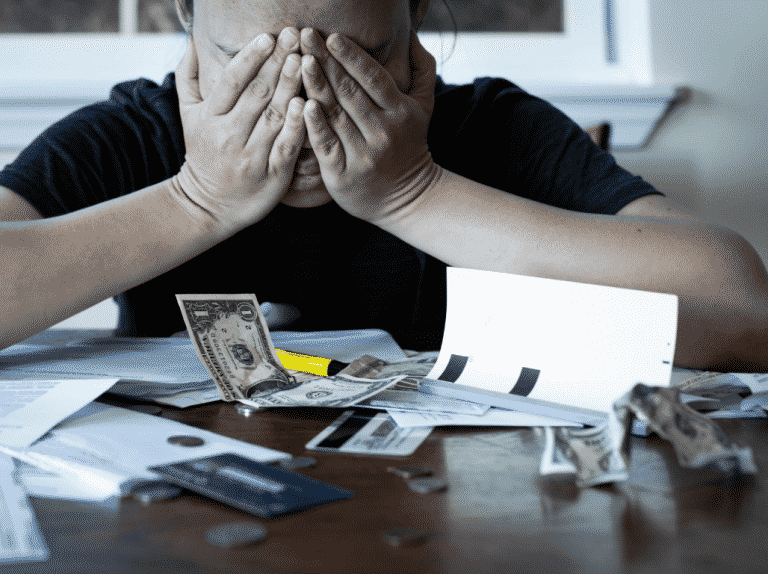

Overwhelmed By Fear Of Finances: Tips To Recovery

If you have constantly in fear of finances and worrying about money, you are not alone! Many of us struggle with our money problems and horrible anxiety around money! But, don’t worry. There is hope for a happy future around money.

For most of my life I had the dread disease of FOF, which simply stated is Fear Of Finances. When I entered a program for financial recovery, one of the things I related to immediately was all the talk about vagueness around money.

Fear Of Finances Made Me Unaware Of What I Had

I never knew how much money was really in my bank account. I was always shocked when taxes came around, and I lived in complete fear of normal things like opening my mail, and paying bills. Even worse, I was terrified of talking about money, particularly in professional settings where I’d find often myself negotiating down before anyone else. Meaning I was the loser in any talk of money, finance, wages, or bills. I was constantly worrying about money but the thing is, it’s not so bad when you know what you’re doing.

Steps To End Your Fear Of Finances

Step 1 Write Down The Numbers

Worrying about money started to change for me when I began the daily practice of writing down my numbers at the end of every day. It’s simply looking at all your receipts and recording everything you spent in categories like: food, shelter, dependent care, and on and on. For 16 categories.

This practice slowly taught me clarity when it came to my finances. Suddenly, I knew every day what I had in the bank, and what I was spending. Sounds so primary, but for people in recovery who never did this before, it was life changing. Truly.

Clarity Ends The Fear Of Finances

After a few months, I had a clear record of where all my money was going. It was frightening and enlightening. I learned things like, I spend an obscene amount of money at Starbucks and 7/11 that should be going to monthly shopping trips that would actually keep me in food for the whole month. I learned I actually had enough money to cover most important things if I adjusted form the not important things – ie., Starbucks and 7/11.

Understanding numbers made negotiating easier

Then when it came to work, I was able to say, I can’t work for less than this amount because this is what it costs for me to live. There’s no shame in saying I can’t work for that amount once you actually know why, and can back it up. But, you have to know what your life actually costs to be able to feel safe,—whether you’re spending, or asking for money. If you work, you have to account for what you’ve contributed.

Finding Clarity Makes Responsibility Possible

Step 1 to banish FOF once and for all is finding clarity. Simply finding some clarity about your habits and how they make you irresponsible with money. With clarity comes peace of mind. Just remember what they say, there’s no fear and faith at the same time. Have faith that if you take the time to de-vague you will in fact de-stress.

Follow us on Instagram!